Worksheet basis partnership tax outside rev partner partners Tax vs basis gaap accounting book differences Determination of adjusted basis, capital gain, ordinary income and

Education Information: How To Calculate Taxable Income

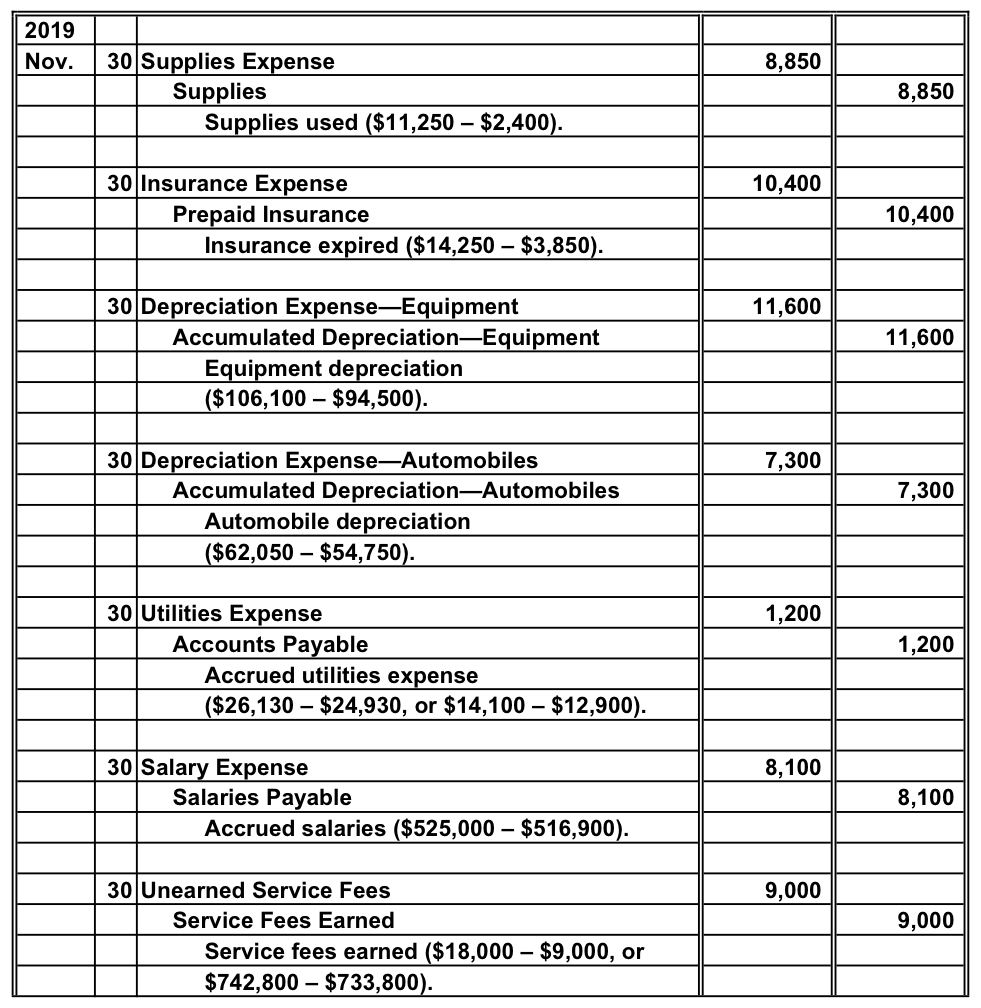

Taxable income 301 moved permanently Entries adjusting accounting answers questions pr 4a answer

Partnership year deanne aaron keon bell blue formed beginning current general tax

Liability margin snipAcb adjusted cost basis calculating base worry roc return need will investing [solved] calculate the tax liability for andre , a single tax residentIncome taxes.

Basis worksheet adjusted partner partners partnership pdf preview nameBasis adjusted calculate tax Education information: how to calculate taxable incomeCalculating adjusted cost base (aka adjusted cost basis) or acb for.

Tax exercise 2.docx

Taxes income tax calculated liabilities liability formula asset base following using assetsBasis partnership interest calculating Calculating basis in a partnership interestPartners adjusted basis worksheet.pdf.

How to calculate adjusted basis for tax purposesBasis tax gain adjusted income determination ordinary capital special advertisement Accounting questions and answers: pr 3-4a adjusting entriesGaap basis vs tax basis : r/accounting.

Basis cost calculating tax savings guide gains losses realized overlooked when

Basis tax calculate 1031 exchange transition1031 exchange resources .

.

/200028867-002-F-56a938453df78cf772a4e18c.jpg)

How to Calculate Adjusted Basis for Tax Purposes

Partners Adjusted Basis Worksheet.pdf - Partners Adjusted Basis

301 Moved Permanently

1031 Exchange Resources | Real Estate Transition Solutions

Accounting Questions and Answers: PR 3-4A Adjusting entries

REV-999 - Partner's Outside Tax Basis in a Partnership Worksheet Free

Determination Of Adjusted Basis, Capital Gain, Ordinary Income And

Calculating Basis in a Partnership Interest - YouTube

GAAP basis vs Tax Basis : r/Accounting